Andres Knobel ■ We trained over 100 tax administration officials to use our Indexes

The Tax Justice Network has been cooperating for years with the Inter-American Center of Tax Administrations (CIAT) to train, learn from and share knowledge with tax administrations on tax abuse mechanisms and what can be done to curtail them.

At CIAT’s International Taxation Network Meeting in Antigua, Guatemala on October 2018, the Tax Justice Network presented the different tools we offer to tax administrations: the Financial Secrecy Index, the Bilateral Financial Secrecy Index, the Corporate Tax Haven Index and the Vulnerability and Exposure to Illicit Financial Flows risks – the latter two of which were under development at the time.

There was so much interest that we offered a free, online in-depth webinar the following month to train tax authorities to use and obtain information from the Financial Secrecy Index to help evaluate and address their exposure to and complicity in financial secrecy.

After the Corporate Tax Haven Index was launched in May 2019, we offered two similar free, online webinars in English and Spanish in July to train tax authorities to use the Corporate Tax Haven Index to evaluate and address their exposure to and complicity in multinational corporate tax abuse.

Over 100 officials from the tax administrations of 16 CIAT member countries from the Americas and Africa participated in the webinars, namely: Angola, Argentina, Barbados, Belize, Bolivia, Brazil, Chile, Costa Rica, Dominican Republic, Guatemala, Guyana, Honduras, Mexico, Paraguay, Suriname and the United States.

Our indexes are mostly known for their ranking of the top worst offenders in terms of financial secrecy and corporate tax havenry. While these ranking systems have proven to be very effective at raising awareness and support for tackling financial secrecy and corporate tax havenry, they only scratch the surface of what the indexes have to offer. For example, the Financial Secrecy Index provides in-depth narrative reports that describe the history and origin of many secrecy jurisdictions. The indexes also provide interactive maps, videos, infographics and podcasts.

The most relevant tools for tax administrations and researchers offered by our indexes are the detailed technical reports available for each country, both on financial secrecy (eg banking secrecy, beneficial ownership transparency) and on corporate tax havenry (lowest available corporate income tax rate, gaps and loopholes, double tax treaty aggressiveness). These detailed technical reports provide a source, date and explanation for each factor each index assesses. They provide objective and verifiable evidence that ultimately results in the indexes’ rankings.

How you can use the indexes

Based on the information available in the Financial Secrecy Index and the Corporate Tax Haven Index, tax authorities, researchers and policy makers can:

- Identify the biggest risks their country faces based on the secrecy and tax avoidance provisions available in their major economic partners (in terms of trade, foreign direct investment, bank deposits, etc).

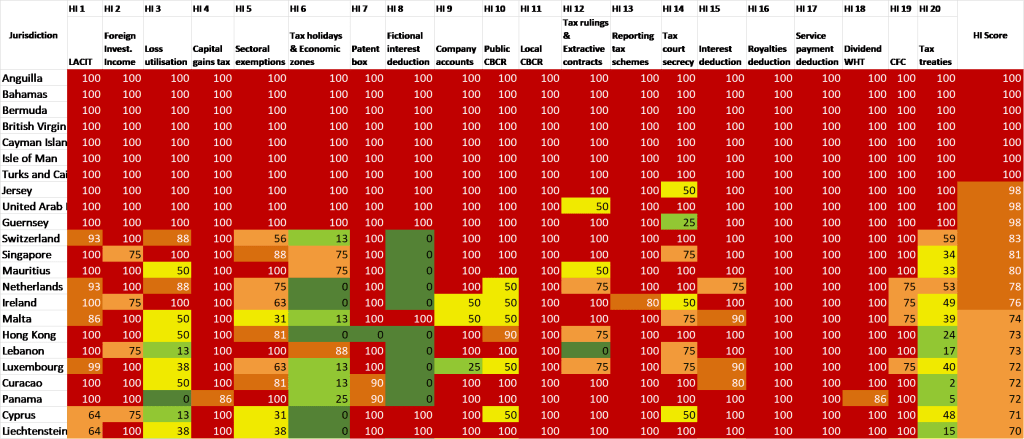

- Tax authorities and researches can create their own indexes that prioritise the policies and issues they care the most about by filtering for the indicators they are interested in, helping them better target their priority areas. Both the Financial Secrecy Index and the Corporate Tax Haven Index offer scorings for free, online and in open data. This means that scores may be downloaded as Excel documents for each country (all scores for one country) or for each indicator (all countries’ scores for one indicator, eg banking secrecy).

- Take action against corporate tax havens and secrecy jurisdictions (based on Africa’s examples), even if those jurisdictions don’t appear on typical tax haven lists.

- Renegotiate, terminate or decide with which countries to establish double tax agreements to prevent lower withholding taxes that have an impact on a country’s tax revenues. For example, Senegal recently moved to cancel its tax treaty with Mauritius, which our Corporate Tax Haven Index revealed to be among the most aggressive tax treaty partner towards Africa countries. Many countries often sign double tax agreements in the hope of receiving tax and banking information from other countries on their resident’s foreign financial affairs. Our indexes reveal which countries do and do not collect the relevant information in the first place, so no matter what the signed treaty says, a country may not be able to receive any information at all. Our indexes can help countries avoid waiving their taxing rights for nothing in return.

- Obtain information for investigations. For example, the Financial Secrecy Index describes what type of legal and beneficial ownership information is available about companies, partnerships, trusts and foundations at each of the 112 jurisdictions’ commercial registries and how to obtain that information. Both indexes also reveal what accounting information is available online and how to obtain a company’s financial statements.

- Follow the methodology and the indicators of both the Financial Secrecy Index and the Corporate Tax Haven Index to understand the criteria used by the Tax Justice Network to assess countries. These indicators also serve as guidance for countries. They indicate what a country should do to improve its own legal framework in terms of transparency and anti-avoidance to protect its own tax base and to prevent becoming a corporate tax haven or secrecy jurisdiction from the perspective of others.

- Countries involved in regulatory reforms may follow the Financial Secrecy Index’s or the Corporate Tax Haven Index’s detailed results by indicator in open data. This way, they may identify best cases of other countries to use as a basis for their own reforms (for this, check best results marked in green and with the lowest possible secrecy score or haven score):

To wrap this all up, the Tax Justice Network’s indexes have a wealth of information ready to be put to use. If you are a researcher, tax authority or policy maker interested in learning more on how to use our indexes to tackle tax abuse and other illicit financial flows, please contact us at [email protected].

Related articles

UN tax convention hub – updates & resources

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)