Alex Cobham ■ Targeting illicit financial flows in the Sustainable Development Goals

The last two decades have seen the emergence of a powerful tax justice movement globally, led by civil society expertise and increasingly by policymakers of the global South. One significant marker of progress has been the establishment of a target to address illicit financial flows, including offshore tax evasion and the tax avoidance of multinational companies, as part of the Sustainable Development Goals. While technical and political challenges remain, progress on civil society’s policy platform for tax transparency means that the data is available to construct robust indicators with the potential to drive change by ensuring accountability at the national level –including the many jurisdictions that benefit from facilitating tax abuses and corruption elsewhere”

This is the conclusion of my briefing paper on the history, importance of, and progress towards, good indicators of illicit financial flows to underpin the Sustainable Development Goals target, now published by leading Madrid think tank the Real Instituto Elcano, in both English and Spanish. [Leer este artículo en español.]

The full paper starts with a detailed discussion of the rise of the illicit flows agenda and the roots of the tax justice movement, including the 4Rs of tax, the ABCs of tax transparency, and the role of leadership from the global South in establishing the issue in the Sustainable Development Goals – despite the attempts of some lobbyists to derail things retrospectively. The technical challenges of measurement are explored, and the paper closes with a summary of the main proposals now being evaluated in the UN process.

Summary

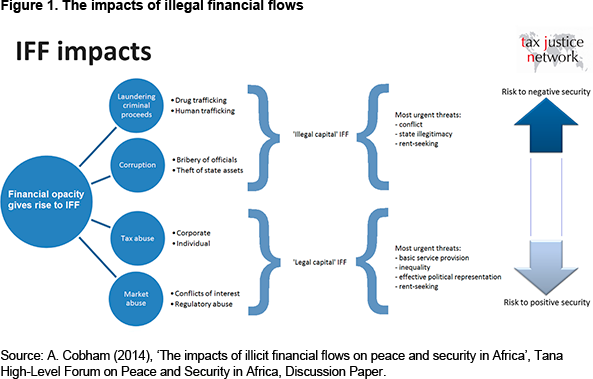

‘Illicit financial flows’ is an umbrella term which covers cross-border movements related to tax avoidance, tax evasion, regulatory abuses, bribery and the theft of state assets, the laundering of the proceeds of crime and the financing of terrorism. While international organisations had been somewhat active in relation to grand corruption and money laundering, it was only with the growing drive of civil society organisations from the early 2000s that the focus shifted to reflect the importance of tax-motivated flows.

Because the necessary expertise was also concentrated there, civil society can claim an unusually large degree of credit for two key differences between the Sustainable Development Goals framework and their predecessor the Millennium Development Goals, which ran from 2000 to 2015. While the latter completely overlooked any role for taxation in development, the new Agenda 2030 not only includes a target devoted to reducing illicit financial flows but also establishes the importance of tax as the primary target in goal 17, related to the overall implementation.

Target 16.4 is not the end of the story, however. Perhaps because of a lack of deep expertise among policymakers and international organisations, both the target and the outline indicator on illicit financial flows suffer from poor drafting. The indicator is likely to be among the last to be confirmed in the entire framework and substantial technical challenges remain. But there are now concrete proposals on the table and an active process underway to test and confirm their potential.

Related articles

UN tax convention hub – updates & resources

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026