Naomi Fowler ■ How come Mauritius is the biggest foreign investor in India?

We’re pleased to share a new study by Suraj Jaiswal for the Centre for Budget and Governance Accountability on Foreign Direct Investment in India and the role of tax havens. As their summary of this study says:

Governments across the world are trying to attract Foreign Direct Investment (FDI) as a policy tool to promote growth, employment, etc. India has also adopted policies for promoting FDI and has seen significant increase in FDI in the decade of 2000 and onwards. In this context, the paper looks at the FDI flows to India between 2004-14. It analyses where the FDI is coming from, especially countries who are regarded as tax havens such as Mauritius and Singapore, and tries to explain the reasons behind it.

The paper makes use of a unique dataset which identifies the ultimate parent/controlling entity of the individual FDI inflows, and thus able to identify which FDI inflow is coming directly from the home country of investor and which are routed through the other country. To find the reasons behind the routing of FDI through a third country, it analyses the secrecy aspect as well as the tax agreement of that country with India to find the linkages between secrecy, tax agreements and routing of FDI to India.”

And so, here’s a guest blog from researcher Suraj Jaiswal:

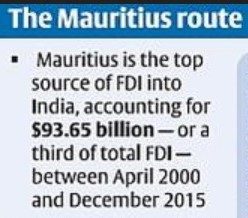

Consider the following fact – between 2000 and 2017, of all the Foreign Direct Investment (FDI) India received, the largest share of 34 percent came from Mauritius.

If one looks at this fact from a investor-investee relationship, the question arises – how can a country with a GDP of 12 billion USD be the largest foreign investor in a country with a GDP of over 2 trillion USD ? If one looks at the comparison between different foreign investors investing in India, the question then becomes how can a country like Mauritius invest over five times more in India than the investments made by countries like the USA, the UK and Japan?

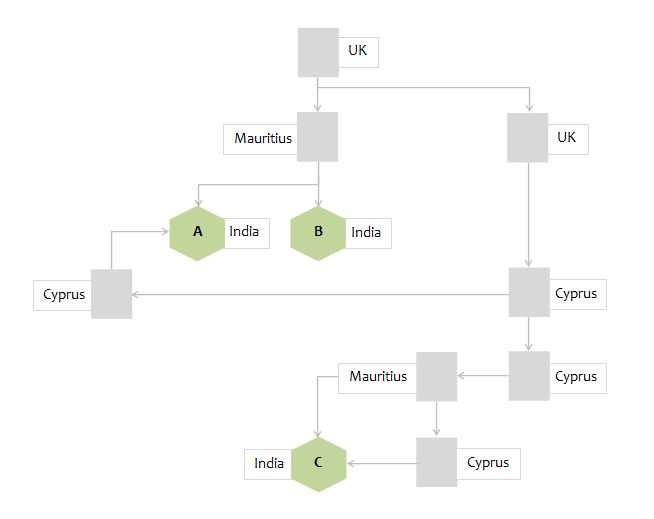

Both of these questions can be answered by the following picture:

The above picture is a replica of a real multinational corporation and it explains a corporate structure. The boxes represent a company/subsidiary, the country’s name alongside the box represents where that particular entity is based, and the arrow represents the ownership and investment direction. The green boxes are the ones who are undertaking actual business/economic operations, while the grey ones are used only for the routing of investment or other financial flows. In this particular example, a company based in the UK makes an investment in three Indian firms, namely A, B and C, through a number of subsidiaries based in Mauritius and Cyprus. For these investments, the country reported as the source of investment will be Mauritius and Cyprus, while in actuality the investment is coming from the UK.

The Centre for Budget and Governance Accountability (CBGA), a think tank based in New Delhi India, recently did a study focusing the FDI inflows to India during the period from 2004 to 2014. The study analyses each individual investment inflow to India during the period 2004-14. The intention was to calculate out of all investments coming in to India, how much is being routed through a third country, and the reason for choosing a specific country to route the investment. The findings of the study reveal many interesting insights.

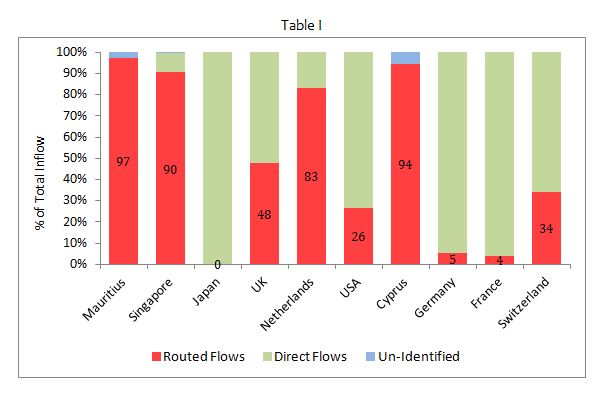

Table I above shows that of the top 10 countries reported as the largest source of FDI in India, how much of these investments are actually from there and how much is actually investment from some other country being routed through there.

Countries which are regarded as tax havens have a very high percentage of routed funds, with Mauritius, Singapore and Cyprus having a share of over 90 percent. This means that more than 90 percent of investments from these countries are basically investments from some other country, but are routed through there.

This begs the question – why do firms route their investment through a third country and how do they choose which country to use for routing the funds? The answer to these questions lies in the process known as “Treaty Shopping”. To understand what treaty shopping is, consider the following example – let’s say there’s an investor based in Britain who wants to make an investment in India. This investment and the gains made by it will be subject to taxation rules which will be a combination of Indian law, British law and the Double Tax Avoidance Agreement (DTAA) signed between India and Britain. Let’s consider another case where an investment is made in India via Mauritius. In this case as well, the investment and the gains from it will be subject to a combination of Indian law, Mauritian law and the DTAA between India and Mauritius. If the investor finds that the investment made via Mauritius is subject to an overall lower tax rate than an investment made from Britain, he/she will first move the money to Mauritius, establish a shell company there and then invest in India. This way, the investor based in Britain will take advantage of the benefits of the lower tax rate arising from the Indo-Mauritian tax treaty; this process is known as treaty shopping.

The study finds that the tax treaties of India with all four of these countries, which host over 80 percent of routed investments, provide preferable tax benefits to investments made from those countries, and that is a major reason for the re-routing of investments. Coming back to the question this article started with – how is Mauritius the biggest foreign investor in India? The answer is treaty shopping.

Further information:The author is with the Centre for Budget and Governance Accountability in New Delhi, India and can be reached at [email protected]. Views are personal. The full study can be accessed here.

NB: In 2016, the Indian government amended its tax treaty with Mauritius, Singapore and Cyprus. After these amendments, the preferential tax benefits were removed partially starting in the fiscal year of 2017, and will be removed completely starting fiscal year 2019.

Related articles

UN tax convention hub – updates & resources

Taxing Ethiopian women for bleeding

Tax justice and the women who hold broken systems together

Malta: the EU’s secret tax sieve

The bitter taste of tax dodging: Starbucks’ ‘Swiss swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026

That means government of India must have lost billions of dollars of tax money from FDI coming through these tax exempted countries.

Government should have removed this lower tax treaty long ago. Anyways, better late than neve.