Nick Shaxson ■ Tax chart of the day: US taxes

We’ve just blogged Citizens for Tax Justice’s latest report on U.S. Fortune 500 companies and their unpaid taxes. Now, from the Financial Times, a chart.

We’ve just blogged Citizens for Tax Justice’s latest report on U.S. Fortune 500 companies and their unpaid taxes. Now, from the Financial Times, a chart.

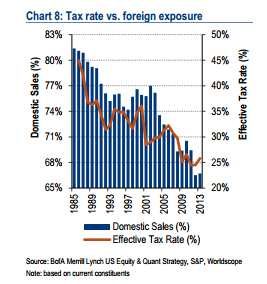

The graph shows starkly one of the great faultlines in globalisation. The FT cites Bank of America analysts as saying that falling tax rates are the biggest factor pushing up profit margins at non-financial S&P 500 companies above the historic average:

“Roughly two-thirds of the improvement in net margins can be attributed to changes below the operating line, specifically interest expense and taxes.”

And those improvements in net margins are being shovelled, very significantly, into executive remuneration. Yet again, improvements in profitability (or executive remuneration, for that matter) are so often not attributable to executive talent, but to other factors. The trillions held offshore, uninvested, are a sign that those profits, extracted substantially from workers and ordinary taxpayers, aren’t being ploughed back into productive invesments.

A quote from the ubiquitous Thomas Piketty (and yes, some of us have read it, cover to cover):

“The reduction of top marginal income tax rates and the rise of top incomes do not seem to have stimulated productivity (contrary to the predictions of the supply side theory) or at any rate did not stimulate production enough to be statistically detectable at the macro level. (P510)

. . .

Our findings suggest that sky-rocketing executive pay is fairly well explained by the bargaining model (lower marginal tax rates encourage executives to negotiate harder for higher pay) and does not have much to do with a hypothetical increase in managerial productivity.” (p512)

Related articles

UN tax convention hub – updates & resources

Malta: the EU’s secret tax sieve

The Bitter Taste of Tax Dodging: Starbucks’ ‘Swiss Swindle’

Disservicing the South: ICC report on Article 12AA and its various flaws

11 February 2026

What Kwame Nkrumah knew about profit shifting

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)