Naomi Fowler ■ Australian beer drinker tax vs the world’s biggest gas companies

Is it fair that Australians pay more tax on one beer than the oil and gas industry pays in petroleum tax on offshore gas in a year? Might a 10% royalty guaranteeing annual revenue of between $1.3 billion and $2.8 billion be a better way to go? These are the issues rightly raised by a report just out by the McKell Institute called ‘Harnessing the Boom.’ It was written by Richard Holden, a Professor of Economics at UNSW Business School. There are some great resources on a campaign site over this issue here. One of our colleagues at Tax Justice Network Australia Jason Ward takes up the story for us here:

The Tax Justice Network Australia (TJN-Aus) has had major wins in getting the Australian government to tackle corporate tax dodging. Currently TJN-Aus is running a campaign to push the government to reform the primary tax on oil and gas production, the Petroleum Rent Resource Tax (PRRT).

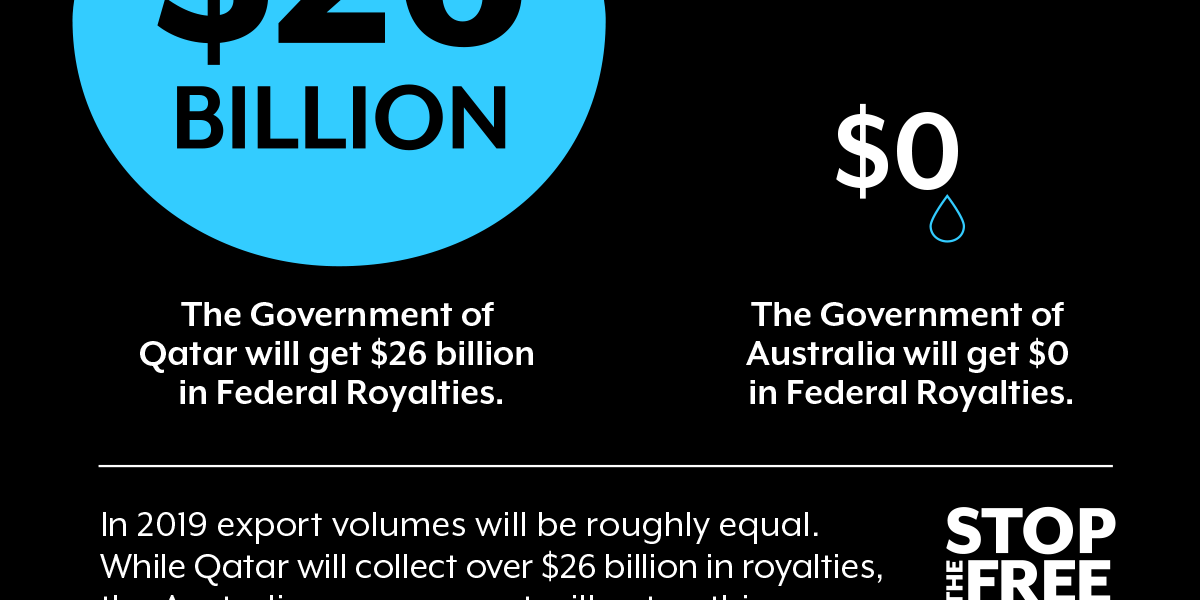

The current boom in exports of liquified natural gas (LNG) will catapult Australia over Qatar as the world’s largest exporter. However, on the same volume in 2019/20 Qatar will generate over $26 billion in royalties will Australia will earn nothing in PRRT from LNG. Qatar will also earn significantly more revenue from dividends from state-owned companies and corporate income tax payments.

Australia’s conservative government acknowledged TJN-Aus’s efforts when it established a review of the PRRT in November. That review will report to the government in the weeks ahead. The Senate Inquiry into Corporate Tax Avoidance has also been extended to look specifically at tax avoidance in the offshore oil and gas industry and a public hearing is scheduled for the end of April.

Chevron, the largest owner of LNG, was already labelled as Australia’s largest tax dodger in previous hearings of the Senate Inquiry. The Australian Tax Office (ATO) took Chevron to the federal court and won a landmark case on the transfer pricing of money. The case involves high interest related party loans between subsidiaries in Australia and Delaware, and will set an important legal precedent with global implications. A current and much larger loan is also under audit by the ATO. This hybrid loan could reduce tax revenue in Australia by $15 billion and creates tax free interest payments in Delaware.

The ATO has been actively pursuing oil and gas companies on a range of aggressive tax avoidance strategies. The ATO’s recent submission to the Senate Inquiry lays out some of the industry’s key tax dodging schemes.

TJN-Aus, has proposed extending a 10 per cent royalty to cover five new offshore LNG projects that do not pay any royalties, and are only subject to the PRRT. We now know that at today’s prices -and without change- these projects, owned and operated by Chevron, Shell and Exxon, will never pay a cent of royalties. TJN’s proposal would raise up to $2.8 billion per year in additional revenues which is desperately needed to fund schools, hospitals and infrastructure. TJN-Aus has garnered widespread support for this common-sense proposal that levels the playing field across the oil and gas industry.

TJN-Aus recently asked a simple pub test question: Is it fair that you pay more tax on one beer than the oil and gas industry pays in petroleum tax on offshore gas in a year?

For more information and to support our efforts please visit: https://stopfreegas.org/

Related articles

Negotiating Tax at the United Nations: An introductory factsheet from an EU perspective

18 February 2025

Trump’s walkout fumble is a golden window to push ahead with a UN tax convention

Just Transition and Human Rights: Response to the call for input by the Office of the UN High Commissioner for Human Rights

13 January 2025

Tax Justice transformational moments of 2024

The Tax Justice Network’s most read pieces of 2024

Breaking the silos of tax and climate: climate tax policy under the UN Framework Convention on International Tax Cooperation.

Seven principles of good taxation for climate finance

9 December 2024

Joint statement: It’s time for the OECD to walk the talk on human rights