Nick Shaxson ■ Exposed: Illegal Gold, Trade Mis-Invoicing And Tax Fraud In South Africa

A guest blog by Naomi Fowler, via the Financial Transparency Coalition:

A guest blog by Naomi Fowler, via the Financial Transparency Coalition:

A powerful 20 minute film just out from Carte Blanche, a major South African investigative news programme lifts the lid on the country’s illegal mining sector.

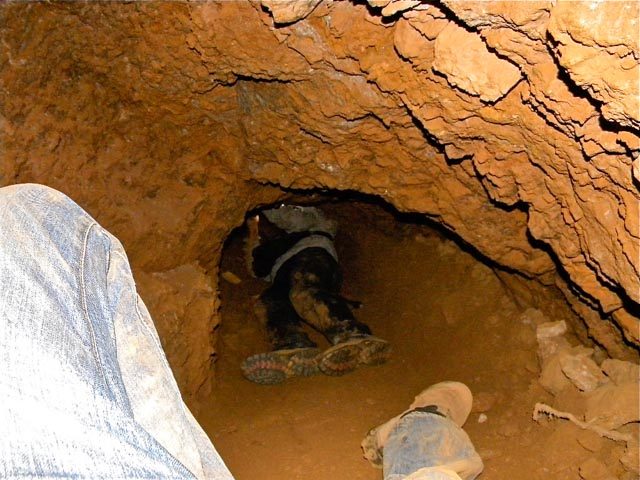

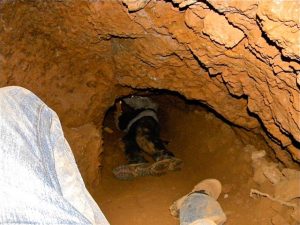

The film takes us on a journey where “poor, desperate people” brave gunmen to go underground to look for gold in atrocious conditions. We witness illegal gold trades by a headteacher on his own school grounds during school hours and hear from gold traders making 10 million rand a month (about $900,000).

The film shows us the “new randlords” and organised crime syndicates who rake in billions buying black market gold. But the value of this gold is only part of the story. The real money-spinner from this activity is a massive tax fraud.

It’s beguilingly simple and it works like this: The South African government doesn’t charge Value Added Tax (VAT) on mined gold. But processed gold is subject to VAT. So, if you “legitimise” illegally mined gold by disguising it as second hand scrap gold and forging a paper trail, you can claim back VAT you never paid.

As one of the interviewees in the film puts it, this is “purely stealing money out of the coffers of government.”

This legitimisation process means an army of pen pushers or “invoice writers” create false identities and use trade mis-invoicing tricks to produce ‘truck loads’ of false documentation convincing enough to pass audits from the tax authorities.

That’s how South African taxpayers end up paying these traders 14% VAT over and above what they make on their illicit gold. The tax authorities in South Africa estimate there are billions of rands at stake and they’ve told Parliament it’s time to close the loophole.

It almost goes without saying this money pouring out of the South African Treasury could instead be invested in public services to improve the lives of ordinary people and addressing the huge inequalities in the country.

The film was produced by Carte Blanche’s Susan Comrie and Graham Coetzer. Last year, Comrie attended the Illicit Finance Journalism Programme (IFJP) in London, which trains and mentors journalists with the aim of increasing the quantity and quality of illicit finance coverage in the media predominantly in emerging and developing countries.

The IFJP is part funded by the Financial Transparency Coalition and works with the Centre of Investigative Journalism in London and the Tax Justice Network. “The entire course sensitised me to the issue of tax and how it plays a role in organised crime and illegal financial deals,” she said.

You can see Susan’s superb film here:

Part 1: http://carteblanche.dstv.com/player/628754/

Part 2: http://carteblanche.dstv.com/player/628904/

Related articles

🔴UN tax convention hub – live talks updates

The last chance

2 February 2026

After Nairobi and ahead of New York: Updates to our UN Tax Convention resources and our database of positions

Taxing windfall profits in the energy sector

14 January 2026

The tax justice stories that defined 2025

The best of times, the worst of times (please give generously!)

Let’s make Elon Musk the world’s richest man this Christmas!

Admin Data for Tax Justice: A New Global Initiative Advancing the Use of Administrative Data for Tax Research

2025: The year tax justice became part of the world’s problem-solving infrastructure

Bled dry: The gendered impact of tax abuse, illicit financial flows and debt in Africa

Bled Dry: How tax abuse, illicit financial flows and debt affect women and girls in Africa

9 December 2025