Nick Shaxson ■ Number Renouncing US Citizenship rose 221% in 2013, in tax panic

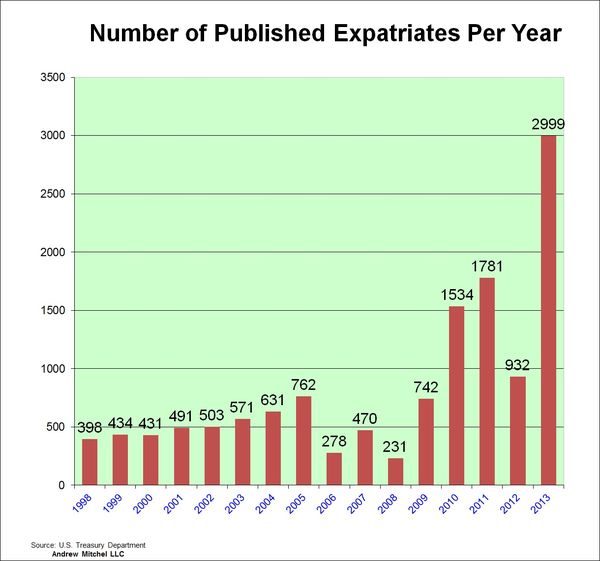

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it’s all about tax, tax, and tax (26 mentions of the t-word, in fact, in this very short story). It’s accompanied by this pretty scary graph (thanks to TaxProf). As the contributor says:

That headline is at least what this contributor would have you take away from his latest column in Forbes. And of course the article speculates that it’s all about tax, tax, and tax (26 mentions of the t-word, in fact, in this very short story). It’s accompanied by this pretty scary graph (thanks to TaxProf). As the contributor says:

“Some go so far as to say that the U.S. tax and disclosure laws are downright oppressive.”

Panic! (and the Wall Street Journal is joining in the party, as usual.)

Now here’s another way to spin the same story.

0.0009 percent of Americans renounced US citizenship in 2013.

Nearly three thousand Americans renounced their citizenship in 2013 – nearly a quarter as many as the number of people from the Dominican Republic who gained U.S. citizenship through naturalisation. In all, the number of foreigners who became U.S. citizens through naturalisation was 757,434 – more than 250 times as many as renounced citizenship.

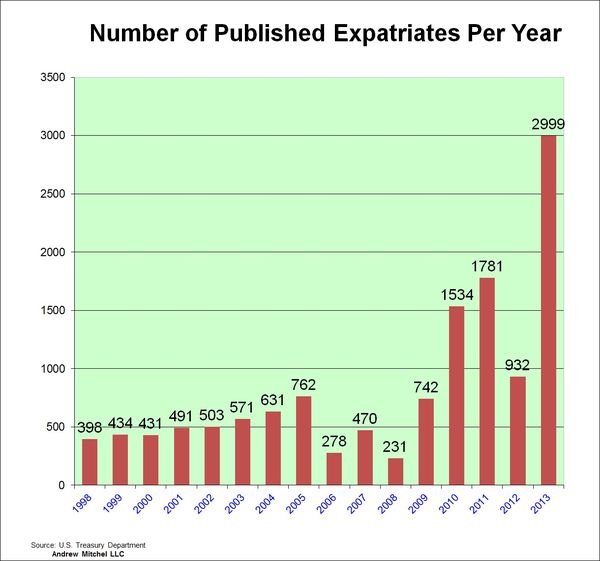

OK, panic over. And here’s a nice little graph, just to ‘prove’ our point.

OK, panic over. And here’s a nice little graph, just to ‘prove’ our point.

Sure, the kinds of people renouncing U.S. citizenship are likely to be generally different from those gaining it by naturalisation. They may well be wealthier, and a few of them may even be motivated purely by tax considerations.

But it’s not likely to be very dramatic. As we have pointed out before: when tax rates (or enforcement or whatever) change, only a small handful of tax extremists rip their kids out of school and leave all their friends and family behind to start brave new lives in bizarre, soulless places like Monaco or the Cayman Islands.

Is the enforcement of U.S. tax laws becoming ‘downright oppressive?’

Well, that’s a matter of taste. But here we might mention this little factoid, from the New York Times:

In current dollars, the I.R.S. enforcement budget declined from $5.9 billion in 2010 to $5 billion in 2013 . . . a 15 percent cut in inflation-adjusted spending.

. . .

the number of audits has dropped and that revenue resulting from audits plummeted $7 billion, or roughly 40 percent, in the three years through 2013.

If it’s oppressive, then it’s certainly getting less so for wealthy taxpayers, who (quite reasonably) tend to be the bigger focus of tax audits.

So it’s not really about tax, after all.

Let’s leave the last word for our tax-obsessed Forbes contributor.

“Most expatriations are probably motivated primarily by factors such as family and convenience.”

So there you have it!

(One small final detail, which we ought to mention. Our hypothetical article above used two different years: 2013 for the Forbes data and 2012 for the naturalisations data, which is the latest available. But hey. The general point stands.)

Related articles

🔴Live: UN tax convention hub

‘Illicit financial flows as a definition is the elephant in the room’ — India at the UN tax negotiations

Taxation as Climate Reparations: Who Should Pay for the Crisis?

Tackling Profit Shifting in the Oil and Gas Sector for a Just Transition

The State of Tax Justice 2025

Follow the money: Rethinking geographical risk assessment in money laundering

Democracy, Natural Resources, and the use of Tax Havens by Firms in Emerging Markets

Why Climate Justice Needs Tax Sovereignty

Why are we gathering in Brazil to talk climate? Why now?

Know your red flags: Geographic risks in (suspicious) transaction monitoring

28 August 2025